6 Jalan TP3 UEP Subang Jaya Industrial Park 47620 Subang Jaya Selangor Malaysia. FC was started issued since 2 May 2019.

Import Duty On Luxury Cars Such As Mercedes Bmw Audi Bentley Jaguar Rolls Royce And Others

3 September 2019.

. Ordinary magistrates courts already had this power but the. Brightway Holdings Sdn Bhd Laglove M Sdn Bhd and Biopro M Sdn Bhd. Being in the economic heart of post-war Malaya and early Malaysia.

Basic Customs Duty BCD. The situation in Malaysia and Brunei differs in that local courts do have caning powers over juveniles and in Malaysia these were actually increased in 1999 with new Childrens Courts being given the power to order up to 10 strokes with a light cane for boys aged between 10 and 18. It can vary between 0 to 100.

It was noted that G1M number plates were often abused on luxury vehicles to evade motor vehicle import excise and sales duty in mainland because G1M series could be registered in Langkawi and Labuan. The Cartagena Protocol on Biosafety to the Convention on Biological Diversity is an international agreement on biosafety as a supplement to the Convention on Biological Diversity CBD effective since 2003. YTY Industry Holdings Sdn Bhd YTY Group including YTY Industry Sdn Bhd Green Prospect Sdn Bhd and GP Lumut.

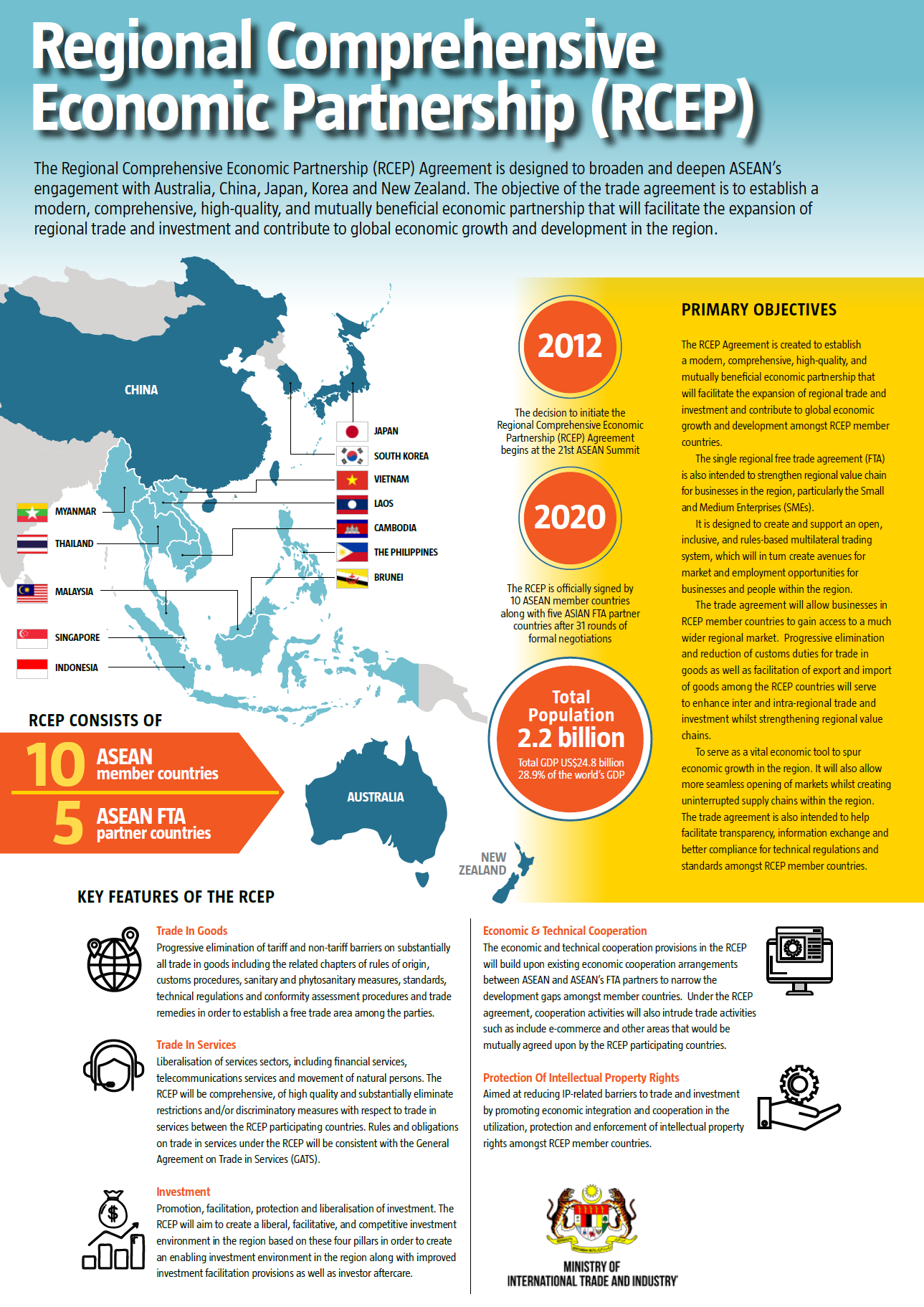

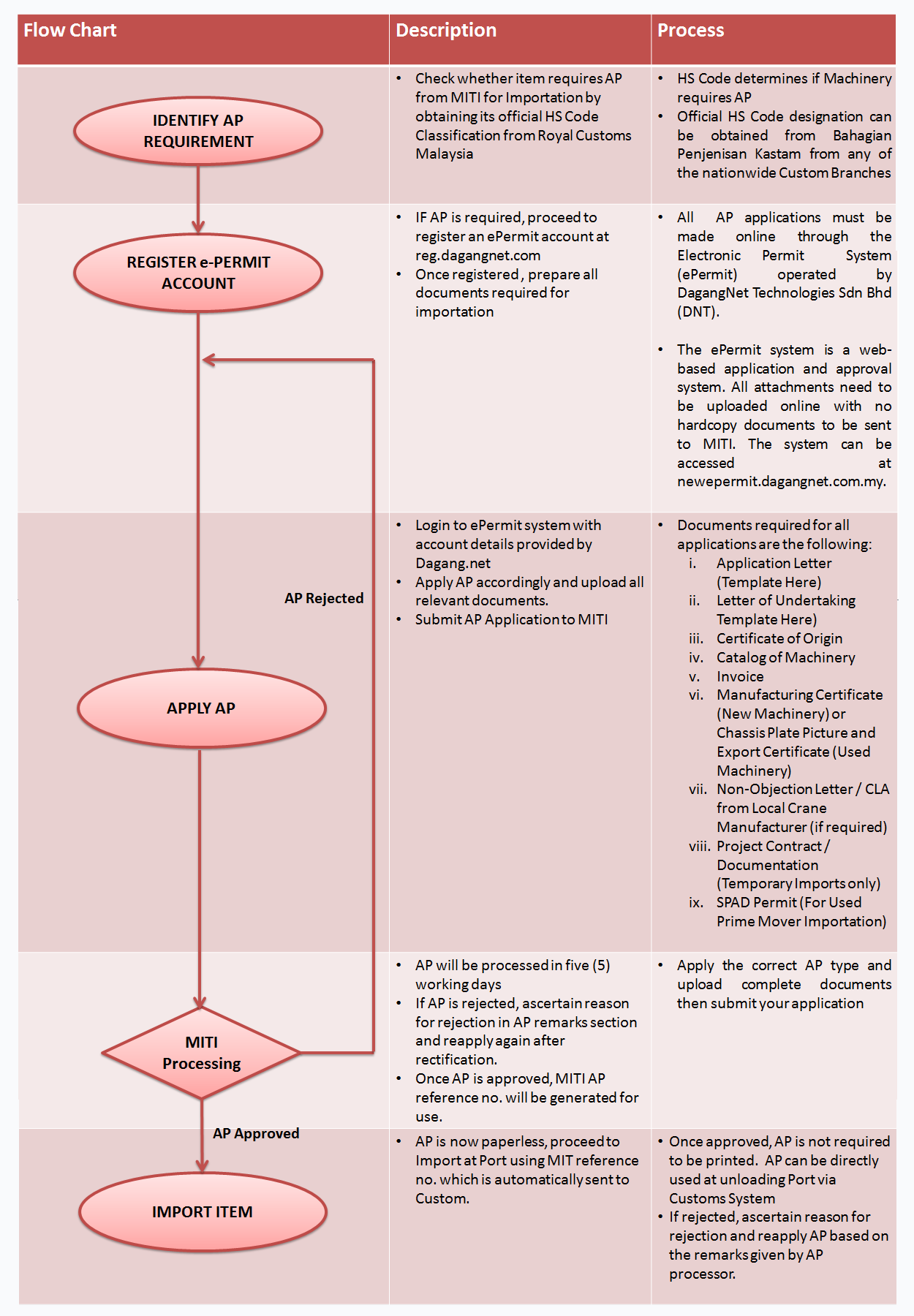

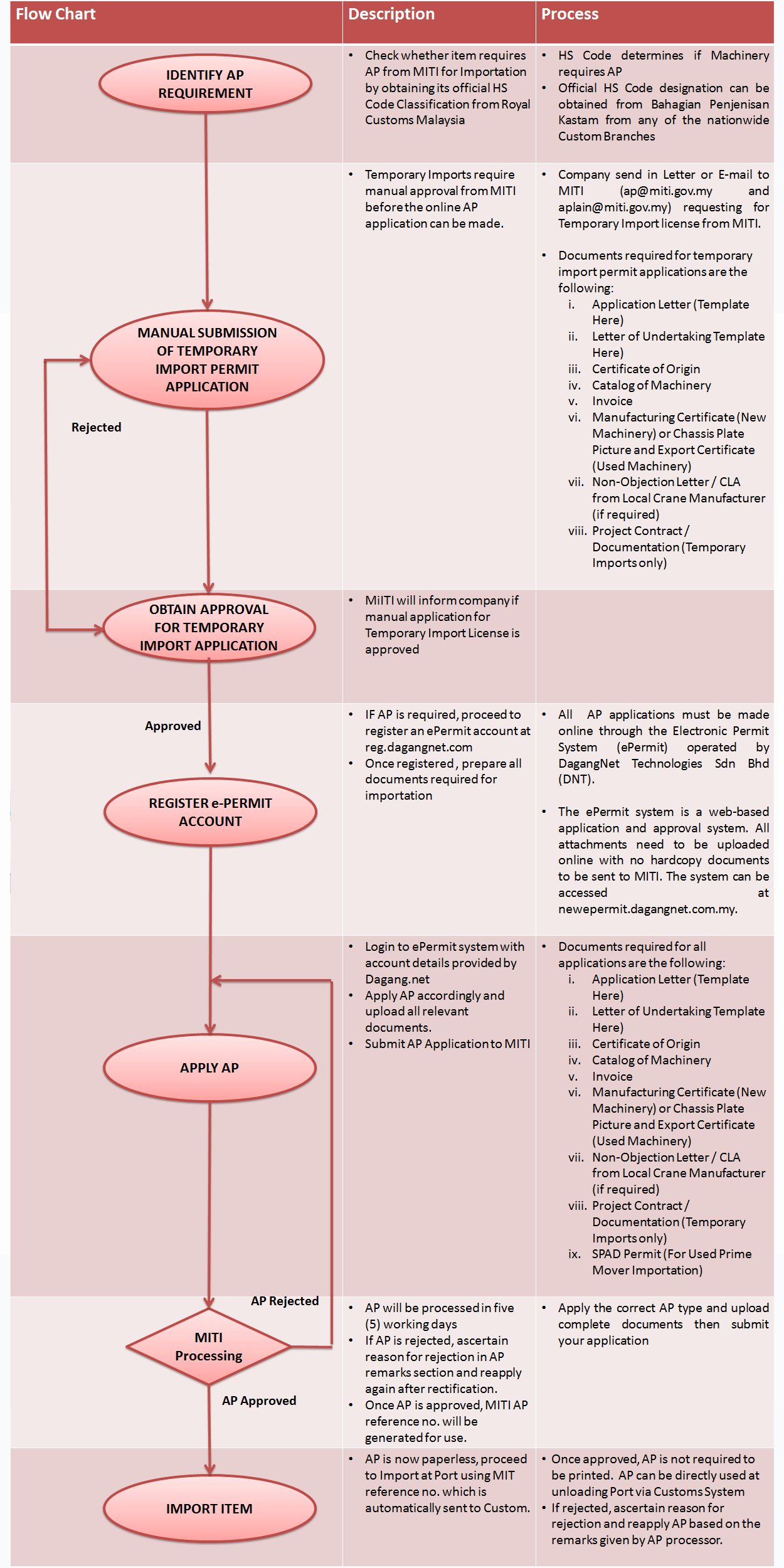

A company undertaking manufacturing and selected services activities may apply for MIDA Confirmation Letter Surat Pengesahan MIDA SPM for the purpose of claiming import duty andor sales tax exemption from Royal Malaysian Customs Department on machineryequipmentspare partsprime moverscontainer trailers subject to the fullfilment of. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax. The Biosafety Protocol seeks to protect biological diversity from the potential risks posed by genetically modified organisms resulting from modern biotechnology.

Anti-dumping duty is an import duty charged in addition to normal Customs Duty and applies across the UK and the whole EU. The position of the king is primarily ceremonial but he is the final arbiter on the appointment of the prime minister head of government. This is the tax that is calculated on the Assessment Value of the goods that have landed at the customs border of India.

Malaysias location has long made it an important cultural economic historical social and trade link between the islands of Southeast Asia and the mainland. Originating in Malaysia Anti-Dumping Duty 2321. However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax.

BCD depends upon the HSN code of the product and the Country of Import. Resigned on 6 January 2019.

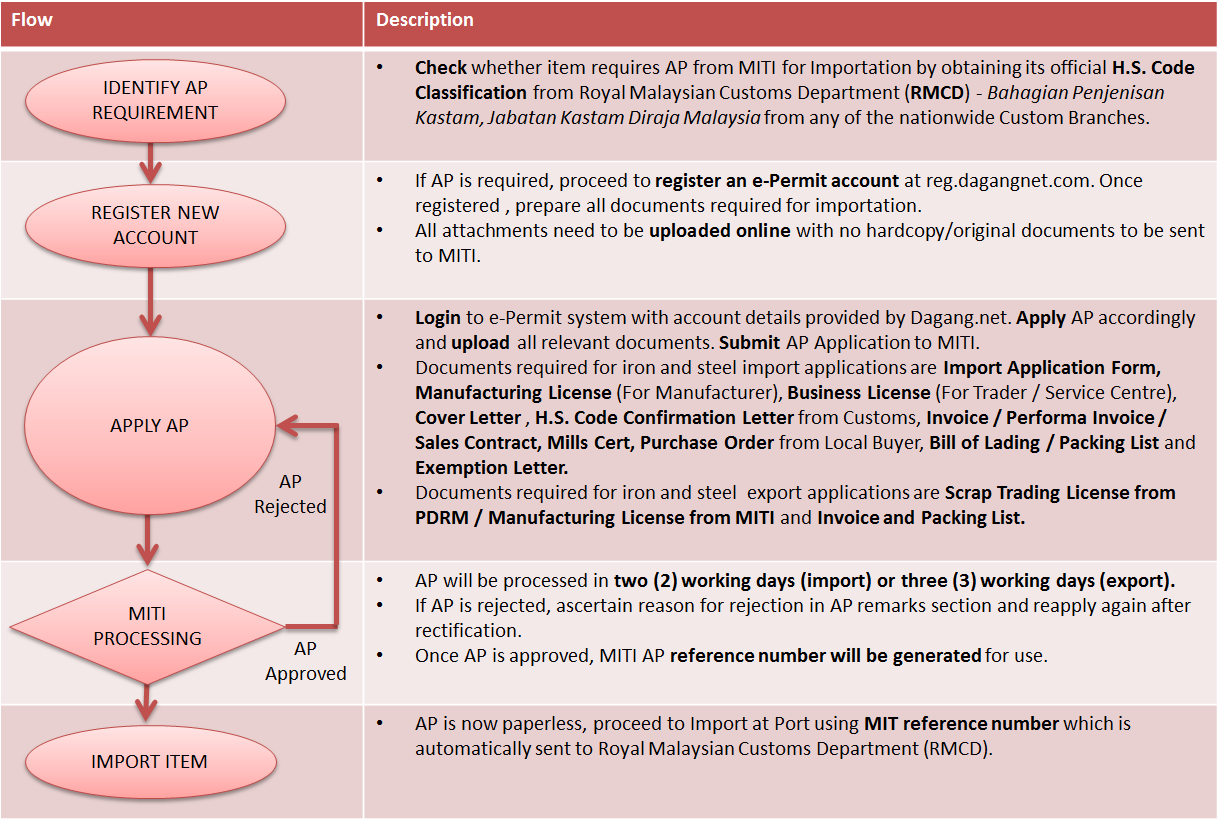

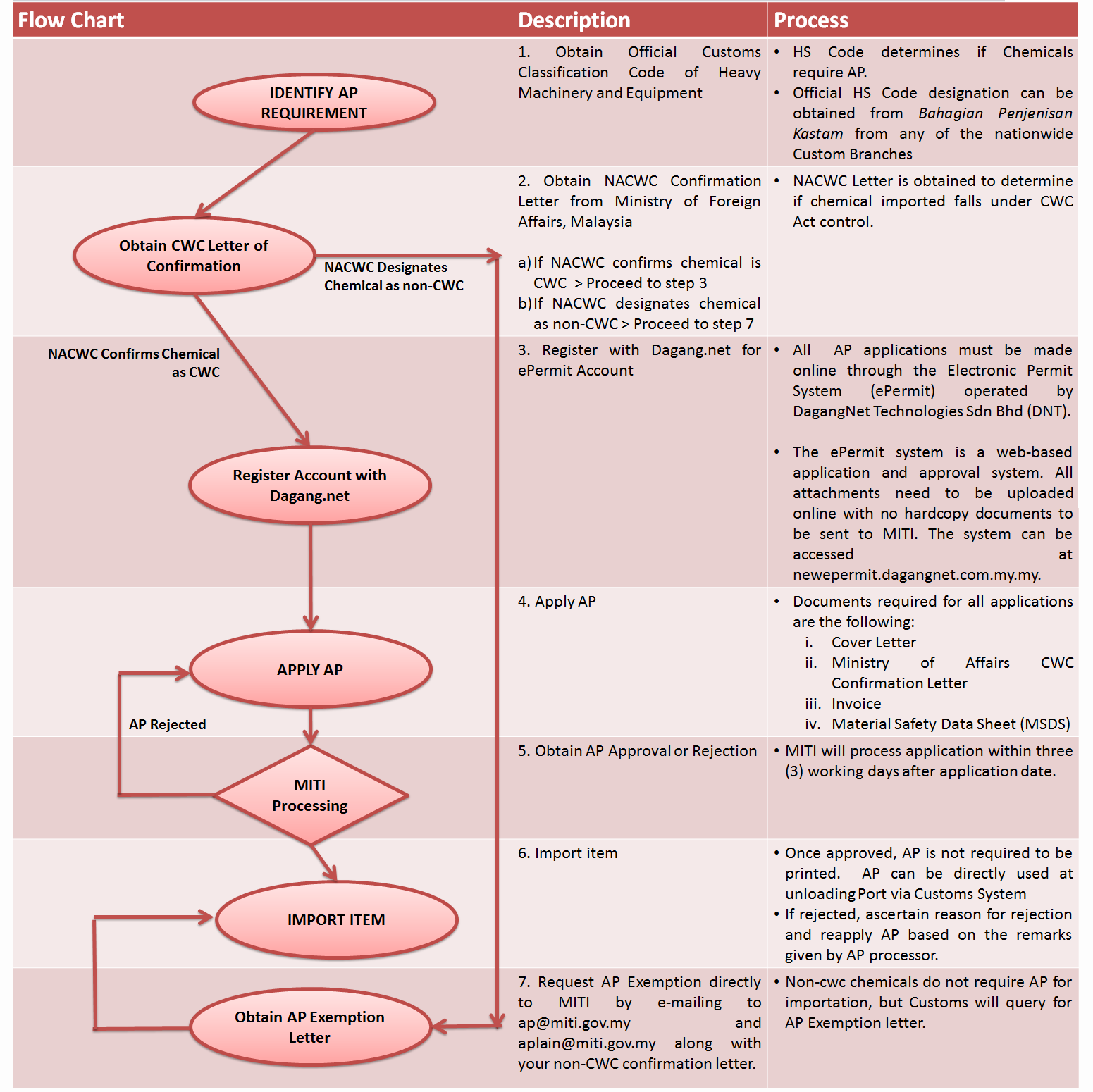

Kementerian Perdagangan Antarabangsa Dan Industri

Where Is The Cheapest Place To Buy Chanel

Kementerian Perdagangan Antarabangsa Dan Industri

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

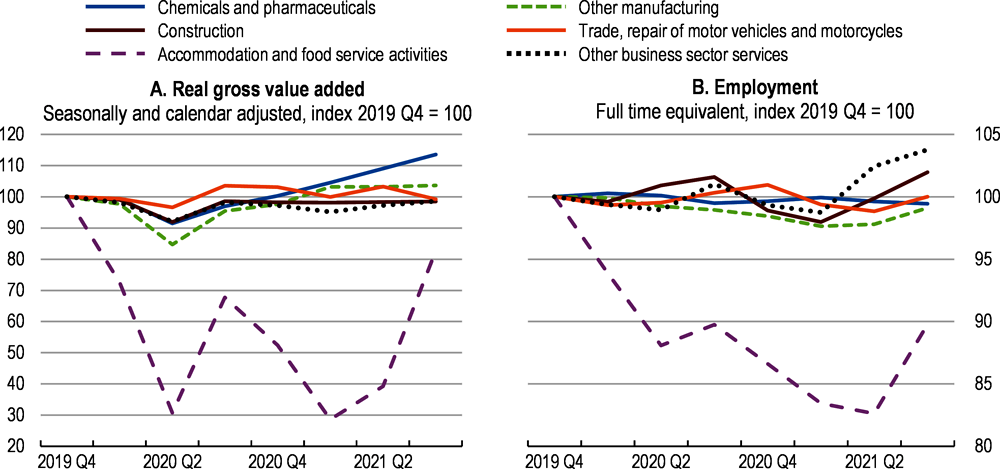

1 Key Policy Insights Oecd Economic Surveys Switzerland 2022 Oecd Ilibrary

See Kannbwx S Tweet On Twitter Twitter

Kementerian Perdagangan Antarabangsa Dan Industri

What The Example Of Montenegro S New Pre Arrival Processing Capabilities Tell Us About Customs Performance Measurement Wco

India Imposes Anti Dumping Duty On Import Of Solar Eva Sheets From 4 Countries Mercom India

Kementerian Perdagangan Antarabangsa Dan Industri

3 The Business Environment For Smes And Entrepreneurship In Viet Nam Sme And Entrepreneurship Policy In Viet Nam Oecd Ilibrary

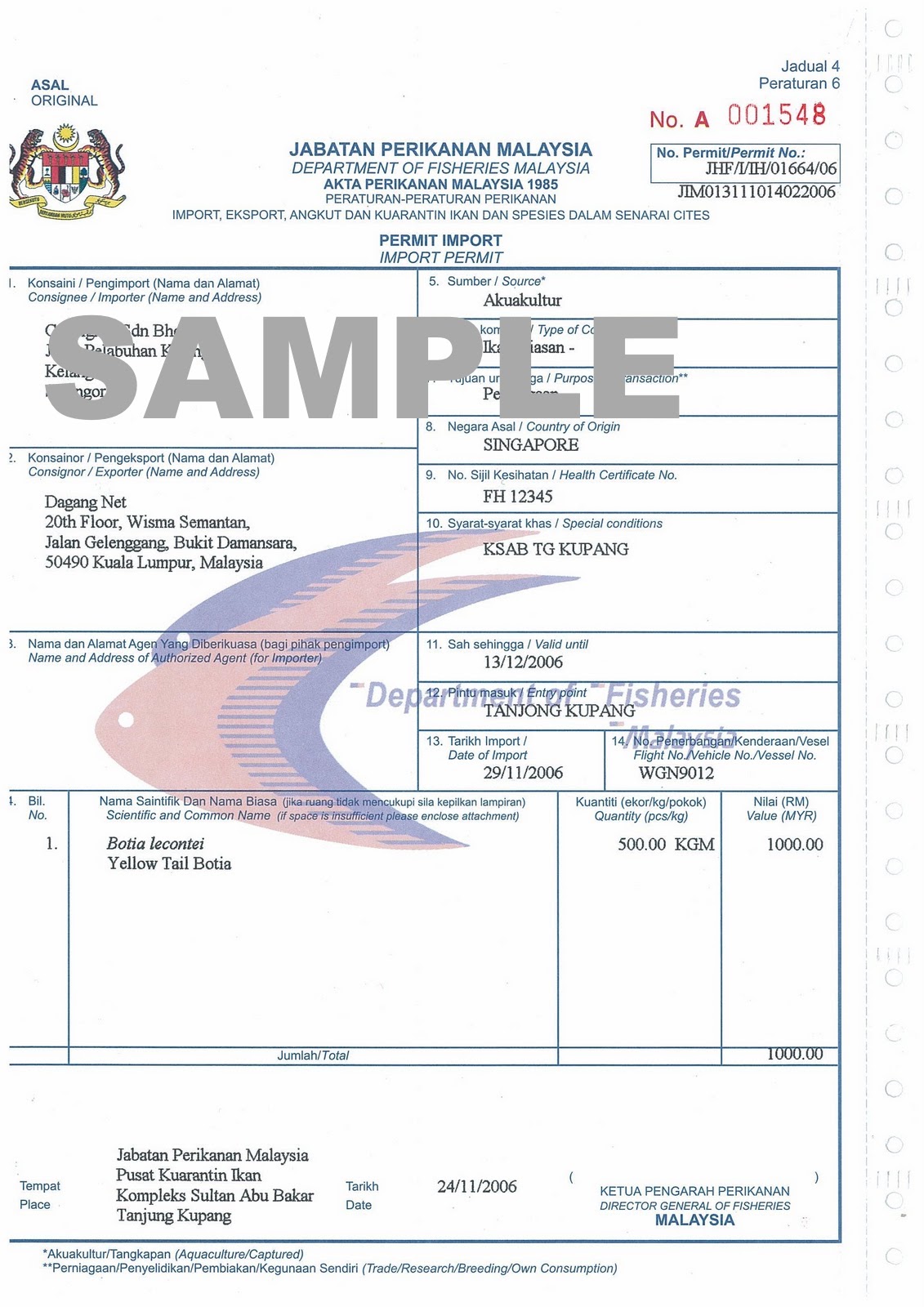

Import And Export Procedures In Malaysia Best Practices Ansarcomp M Sdn Bhd

Pdf Tax And Revenue Trends And Implications In Malaysia

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

Is Malaysia Benefitting From The Us China Trade War East Asia Forum

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org